Planning a Move?

Let's Stay in Touch. Sign up for Touchdown Highlights

8 minute read

Published

October 27

2025

Reviewed by Experts

8 minute read

Published

October 27

2025

Portugal has emerged as a leading hub for entrepreneurs, digital nomads, and investors seeking to open a company. Its strategic position in the EU, modern infrastructure, and competitive tax framework make it ideal for launching startups, tech firms, or service-based ventures.

Sectors like renewable energy, tourism, and digital innovation continue to attract global founders eager to tap into the country’s growing economy.

Understanding how to open a company in Portugal is the first step to building a solid foundation for your business. In this guide, we outline the key steps, legal requirements, and practical tips to help you register and launch your company smoothly and compliantly.

Portugal has become one of Europe’s most attractive destinations for entrepreneurs, investors, and startups. Its combination of economic stability, strategic location, and supportive business environment makes it an ideal place to launch and grow a company.

Starting a business in Portugal is a clear and structured process, though the exact steps may vary depending on your nationality, visa type, and the kind of company you want to create.

Below is a detailed breakdown of each stage:

Before you can officially set up your business, you’ll need to obtain a Número de Identificação Fiscal (NIF) which is Portugal’s tax identification number. It’s required for nearly every legal and financial activity, including company registration, signing contracts, or opening a bank account.

You can apply for a NIF at a local Finanças office or remotely through Touchdown. For foreign entrepreneurs, having a Portuguese tax representative simplifies the process and ensures your application is handled efficiently.

Deciding on the right legal structure is an important early step in setting up your business. Common options include a sole trader for independent professionals, an LDA (similar to an LLC) for small and medium-sized companies, and an SA for larger corporations.

Each structure has its own setup process, tax rules, and liability implications, so take time to assess which best aligns with your business goals.

Once your company structure is decided, the next step is to open a business bank account in Portugal. This account will be used for all company transactions and is required to deposit your initial share capital.

Proof of this deposit is necessary for company registration, so ensure the account is opened in your business’s name and all documents are properly recorded.

The articles of association define your company’s key details, including its purpose, ownership structure, and management rules. In Portugal, you can use a pre-approved model provided by the authorities, which is suitable for most standard setups, or draft custom articles if you want specific terms tailored to your business. In either case, the document must be signed by all partners or shareholders to complete registration.

With your documents ready, you can officially register your company through one of two government platforms. Empresa Online allows you to complete the process digitally, while Empresa na Hora offers in-person registration for same-day setup at designated offices. Once approved, you’ll receive your commercial registration certificate, confirming your company’s legal existence in Portugal.

Touchdown’s expert team can manage the entire company setup process for you, saving time, avoiding errors, and ensuring your business is registered smoothly and compliantly.

After registration, you must declare the start of activity (Declaração de Início de Atividade) with the Portuguese Tax Authority (Autoridade Tributária e Aduaneira). This step activates your company’s tax status for VAT, income tax, and accounting purposes, ensuring you can begin operating and invoicing legally.

All company owners and employees are required to register with Segurança Social (Portugal’s Social Security system). This registration ensures compliance with labor laws and grants access to essential services like healthcare, unemployment benefits, and pensions. For employers, it also establishes contributions for staff social security payments.

Certain industries in Portugal, such as hospitality, construction, real estate, or financial services, require additional licenses or permits before operations can begin. Check the specific regulations for your sector with local authorities or a legal advisor to avoid compliance issues. Securing the right licenses early helps you operate confidently and without interruption.

Selecting the right legal structure is a key decision when starting a business in Portugal. Each option comes with different requirements for capital, liability, and ownership.

The LDA (Sociedade por Quotas) is the most common and versatile structure for small and medium-sized businesses, but it’s important to understand how it compares to other company types.

LDA Portugal is the most popular company type and operates similarly to a limited liability company (LLC). It requires at least two partners (or one in the case of a Sociedade Unipessoal por Quotas).

Each partner’s liability is limited to their share in the company, protecting personal assets from business debts. LDAs are flexible, relatively simple to manage, and ideal for both local entrepreneurs and foreign investors seeking a secure and recognized business model. You will also need to appoint a certified accountant to handle your company’s bookkeeping, tax filings, and compliance with Portuguese accounting regulations.

This is the single-member version of an LDA, allowing one individual to own all company shares. It offers limited liability and can be established with a minimum capital of €1. However, you’ll need to open a dedicated business bank account and hire a certified accountant to manage compliance and reporting.

Designed for larger corporations, an SA requires at least five shareholders and a minimum capital of €50,000. Shares can be publicly traded, and liability is limited to each shareholder’s contribution. However, this model involves more complex governance and reporting standards.

This hybrid model combines managing partners with unlimited liability and silent partners whose liability is limited to their investment. It requires at least €50,000 in capital and is often used for family-owned or investment-focused ventures.

Launching a business in Portugal as a non-EU national involves several legal and administrative steps to ensure compliance with local regulations. Before you can operate, hire employees, or pay taxes, you’ll need to meet the following core requirements.

Not sure which visa fits your profile? Use Touchdown’s free Eligibility Checker to find the best residency or business visa option for your situation.

Starting an online business in Portugal follows the same registration process as any other company but includes additional compliance requirements. Online businesses must follow Portuguese and EU regulations on data protection (GDPR), consumer rights, and e-commerce law, which governs online transactions, pricing transparency, and refund policies. Websites must also display clear terms of service, privacy notices, and contact information to ensure compliance.

Opening a business bank account in Portugal is a necessary part of setting up your company. Most banks require your company registration certificate, Portuguese tax number (NIF), articles of association, and identification for all directors or shareholders. Some may also ask for a business plan or financial projections. Comparing banks based on fees, online banking tools, and international services can help you choose the right fit for your business needs.

The cost of opening a company in Portugal is relatively affordable compared to other EU countries, though the total amount depends on your business type, structure, and whether you use pre-approved or custom incorporation documents.

If you’re registering through the Empresa Online or Empresa na Hora services, the official government fees are:

Beyond registration, you’ll also need to account for minimum share capital, legal fees, and accounting services, which can vary based on your company structure. For example, the minimum share capital is €1 for a sole proprietorship by shares (Sociedade Unipessoal por Quotas), €1 for an LDA, and €50,000 for an SA.

While basic registration can cost as little as €220, it’s realistic to budget between Our fee is 1500 euros to cover notary, legal setup, and other administrative expenses associated with starting your business in Portugal.

When doing business in Portugal, it’s important to understand the country’s main tax rules and accounting obligations to stay compliant. Every company must register with Finanças (the Portuguese Tax Authority), declare its start of activity, and file annual returns based on its structure and income.

Portugal’s tax framework is generally straightforward but can be complex for foreign-owned companies unfamiliar with local rules. Touchdown’s legal and tax experts can help you navigate these requirements, structure your business efficiently, and identify available incentives.

Choosing the right location is an important step when setting up your business in Portugal. While the country offers favorable conditions across most regions, a few cities stand out for their infrastructure, talent pool, and business ecosystem.

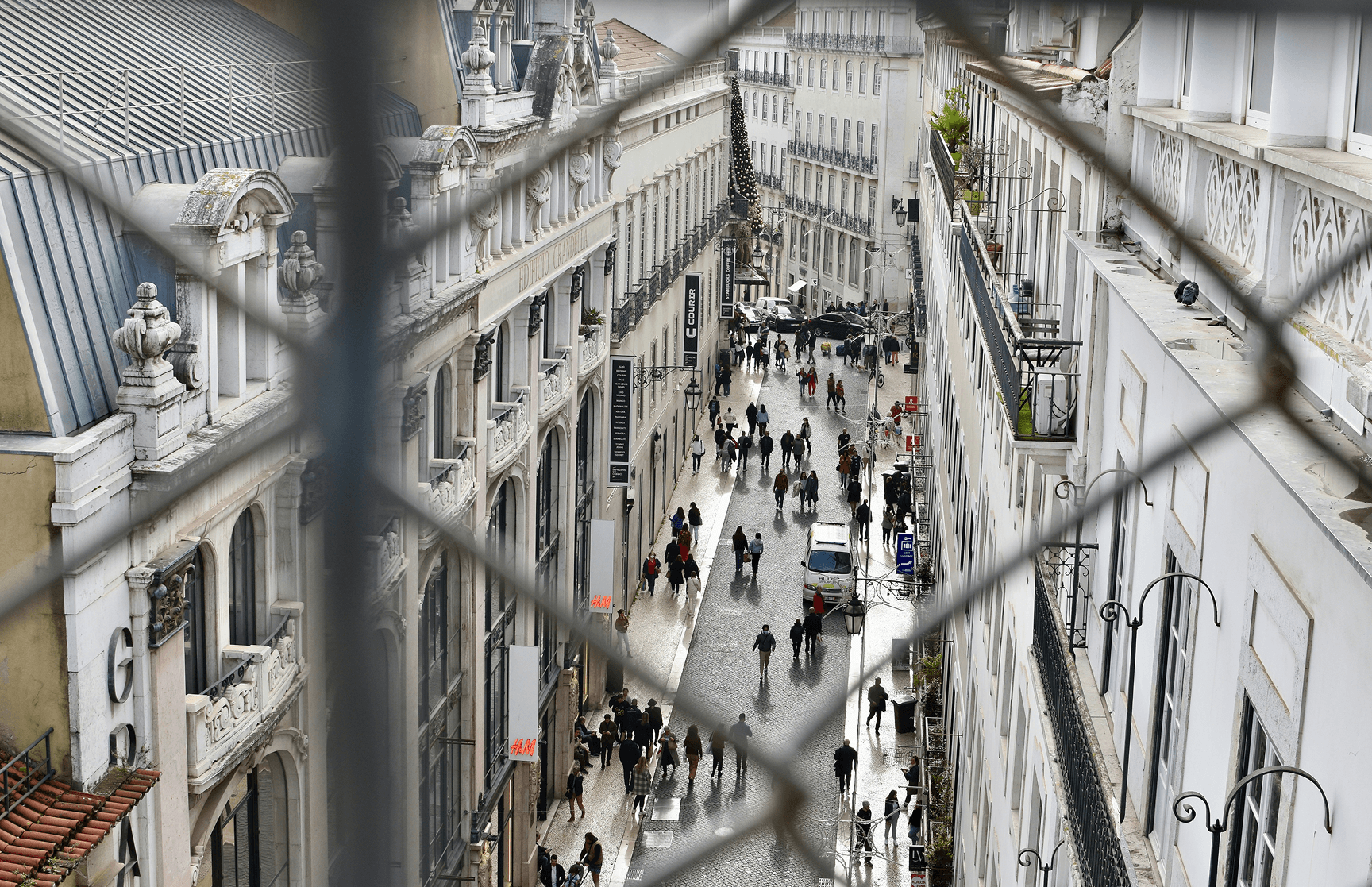

Lisbon is Portugal’s economic and entrepreneurial capital, home to a thriving startup scene, global tech conferences like Web Summit, and major international companies. The city offers excellent connectivity, modern coworking spaces, and a large pool of English-speaking professionals. Government-backed innovation hubs and accelerators, such as Startup Lisboa, make it a prime destination for tech and service-based businesses looking to scale.

Portugal’s second-largest city, Porto, combines industrial tradition with a growing technology and creative sector. It’s known for its lower operating costs compared to Lisbon, while still offering strong infrastructure and a skilled workforce. Porto’s universities supply a steady stream of engineering and business graduates, and the city’s supportive environment has made it a rising hub for software development, logistics, and design-focused companies.

Braga has gained attention as one of Portugal’s fastest-growing business cities, particularly in the tech and innovation sectors. Known for its affordable living costs and high quality of life, Braga appeals to startups and remote-first companies looking for value and talent. It also benefits from proximity to Porto’s international airport and access to several research institutions, making it ideal for emerging companies in R&D, sustainability, and digital industries.

Starting a business in Portugal is relatively straightforward, but foreign entrepreneurs often face a few practical challenges along the way. Being aware of these and having the right local support can make your setup much smoother and more efficient.

Portugal has simplified many administrative processes with online services like Empresa Online and Empresa na Hora. However, tasks such as obtaining visas, registering for taxes, or applying for specific licenses can still involve multiple steps and delays. Preparing your documentation early and working with local professionals helps you avoid unnecessary obstacles.

While English is widely spoken in Portugal’s business community, most official paperwork, contracts, and government websites are written in Portuguese. Misunderstanding official terms or procedures can lead to compliance issues. Partnering with bilingual legal or accounting experts ensures clear communication and prevents costly mistakes.

Portugal’s tax system is well-defined but can be complex for newcomers. Different company types follow specific reporting rules, and strict filing deadlines apply. All companies must appoint a certified accountant to handle bookkeeping, reporting, and tax submissions, which is essential for staying compliant and avoiding penalties.

Setting up a corporate bank account in Portugal can be time-consuming, especially for non-residents. Banks require incorporation documents, proof of tax number, identification for shareholders, and sometimes a business plan. Selecting the right bank and having local representation helps streamline this process and ensures your account is opened correctly.

Hiring employees in Portugal requires adherence to established labor laws, including written contracts, social security registration, and payroll reporting. These requirements can be difficult to navigate without local expertise, so it’s advisable to work with legal and HR professionals who can guide you through the process.

Administrative efficiency varies by region. Major cities like Lisbon and Porto typically handle registrations faster, while smaller municipalities may take longer. Setting realistic expectations and maintaining consistent follow-up with local offices can help you stay on schedule.

Touchdown is Portugal’s premier relocation and business setup platform, built to take the complexity out of moving and launching a company abroad. With an expert team of Portuguese lawyers and business specialists at its core, we bring together everything you need to establish your new life and business through one streamlined platform.

Every entrepreneur’s journey is unique, and we make sure your plan reflects that. Whether you’re starting a company, relocating with family, or investing for the future, Touchdown creates a personalized roadmap around your goals, lifestyle, and long-term vision. Our free Eligibility Checker gives you instant clarity on your best visa or residency options, while our in-house experts guide you through each step with precision and care.

From securing your NIF and opening a business bank account to registering your company, structuring your taxes, and ensuring full compliance, our legal team handles the details so you don’t have to. We also offer dedicated tax consultations and business setup support, helping you understand Portugal’s tax rules for entrepreneurs and expats so you can set yourself up for success.

For comprehensive support, you can book a 1:1 consultation with our specialists. We’ll build a relocation and business setup strategy tailored to you, so you can focus less on paperwork and more on thriving in Portugal with confidence.

Yes. Foreigners, including non-EU nationals, can legally open and operate a company in Portugal. You’ll need a Portuguese tax identification number (NIF), a business bank account, and in some cases, a residency visa such as the D2 Entrepreneur Visa or Golden Visa. Once these are in place, the registration process is straightforward through Empresa Online or Empresa na Hora.

Yes, non-residents can open a company in Portugal without living there. However, you must appoint a fiscal representative in Portugal to handle tax-related correspondence on your behalf. The rest of the process, including obtaining a NIF, opening a business bank account, and registering your company, can be done remotely with professional legal assistance.

LDA Portugal (Sociedade por Quotas) is the Portuguese equivalent of a Limited Liability Company (LLC). It’s the most common company type for small and medium-sized businesses. Each shareholder’s liability is limited to their share of capital, protecting personal assets from company debts. The minimum share capital is typically €5,000, divided among one or more partners.

Absolutely. Portugal offers a stable economy, transparent legal system, and favorable tax environment for entrepreneurs. As an EU member, it provides access to the European single market and enjoys growing international investment. The country also has a strong startup ecosystem, government incentives for innovation, and an exceptional quality of life, making it one of Europe’s most attractive places to start and grow a business.

Author Bio

Henrique Moreira de Sousa

Henrique leads Immigration at Touchdown. Henrique is a Portuguese Lawyer and immigration law specialist that has overseen the relocation of hundreds of expats to Portugal.

Ready. Set. Go.

Try our free eligibility checker now to start your relocation journey

Check Your Eligibility Now

Let's Stay in Touch. Sign up for Touchdown Highlights